Revenue-Based Financing: Grow Your Startup Without Giving Equity.

- Jasaro.in

- Aug 20, 2025

- 5 min read

If you’re building a startup, chances are you’ve already wrestled with one of the hardest parts of entrepreneurship: finding money to grow. Enter Revenue-based Financing (RBF), a flexible, founder-friendly funding option that’s growing in popularity across SaaS, e-commerce, and subscription-based businesses.

Instead of giving up equity (equity financing) or getting locked into fixed monthly payments (debt financing), you raise capital today and repay it as a percentage of your future revenues. In this article, we’ll delwe into what Revenue-based Financing (RBF) is, how it works, its advantages, potential risks & whether it’s the right funding model for your startup.

What is Revenue-based Financing (RBF)?

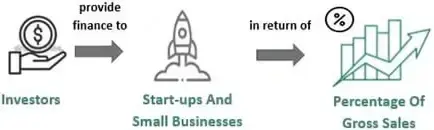

Revenue-Based Financing (aka Revenue-share Financing) is an alternative funding model where-in the investors provides you upfront capital (investment) in exchange for a fixed percentage of your company’s future revenue (5%-10%) until a predetermined repayment cap or multiples (1.2X-1.4X) is met. The repayment period of RBF is typically 3-5 years.

Think of it as a hybrid between debt and equity:

Neither Debt: You don’t pay fixed interest or monthly installments.

Nor Equity: You don’t give away ownership or control.

But, Flexible: You repay only when you make revenue (not a fixed EMI).

The only similarity between RBF and debt financing being that investors are entitled to regular repayments of their initially invested capital.

RBF has become particularly attractive for founders, who want to scale up without diluting ownership or avoid over-burdening themselves with debt obligations.

How Does Revenue-Based Financing Work?

Here’s a step-by-step breakdown of RBF:

1. Funding Agreement

An RBF investor provides capital, say $250,000 based on your revenue projections.

2. Revenue Share

You agree to share a fixed percentage of your monthly revenue (commonly 3%–10%) until you’ve repaid the initial investment plus a multiple (usually 1.3x–2.5x).

3. Repayment Example

Investment: $250,000

Revenue share: 5%

Repayment cap: $312,500 (or a 1.25x multiple on the capital)

Here's what your repayment look like for first few months:

If your startup grows quickly, you repay faster. If growth slows or sales dips, repayment automatically adjusts, so you’re not crushed by fixed debt obligations.

Revenue-Based Financing vs. Equity & Debt Funding

To really understand the appeal of Revenue-Based Financing, let’s compare RBF with the two most common funding options: equity and debt financing.

Equity Financing (Venture Capital / Angel Investors)

Pros: Large capital inflows, mentorship, strategic connections.

Cons: Dilution of ownership, loss of decision-making control, pressure for hyper-growth.

Debt Financing (Bank Loans / Credit)

Pros: Clear repayment terms, maintain full equity.

Cons: Fixed repayments regardless of revenue, requires collateral, difficult for early-stage founders.

Revenue-Based Financing

Pros: Non-dilutive, collateral free, repayment tied to performance, founder-friendly.

Cons: Can be expensive in the long run (repayment multiples), works best for recurring-revenue models (SaaS, Subscription-based & e-commerce with repeat customers).

Advantages of Revenue-Based Financing

Founder-Friendly: You keep 100% of your equity and decision-making power. No board seats, no pressure to scale unnaturally fast.

Flexible Repayments: Since payments are tied to revenue, if you have a slow month, your repayments drop. This reduces financial stress compared to loans.

Faster Access to Capital: RBF providers often make funding decisions in weeks, not months like VCs or banks. They rely more on revenue data and growth potential than collateral or long business plans.

Aligns Investor and Founder Goals: Investors succeed when your revenue grows. Unlike debt collectors, RBF investors want your sales to increase because it speeds up their repayment.

Potential Risks & Challenges of Revenue-Based Financing

No funding model is perfect. Here’s what you need to watch out for:

Higher Cost of Capital: Repaying 1.5x–2.5x the original investment can be pricier than a bank loan.

Not Suitable for All Businesses: RBF works best for predictable, recurring-revenue models. If your cash flow is inconsistent or seasonal, repayment may be unpredictable.

Growth Pressure Still Exists: While less intense than VC pressure, there’s still an incentive to grow fast so repayments don’t drag on.

Who Should Consider Revenue-Based Financing?

RBF isn’t for everyone. But it’s a great fit if you are:

A SaaS startup with monthly recurring revenue (MRR).

An e-commerce business with stable sales volume.

A subscription-based company (gyms, subscription boxes, media platforms).

An early-stage founder who doesn’t want to give up equity.

If your business relies on one-time, high-ticket sales or long sales cycles, for pre-revenue startups, and companies with very low gross margins, RBF may not be the best option.

It's worth exploring RBF, when:

You've Predictable Revenues - at least 6-12 months of consistent revenue history.

You've Healthy Gross Margins - typically 50+% for e-commerce, 80+% for SaaS.

You've a Clear, Scalable Use for the Funds - LTV to CAC ratio of 3:1.

You're Fiercely Protective of Your Equity and Control (board seat.)

Leading Revenue-Based Financing Providers

Several companies now specialize in RBF. Some well-known players include:

GetVantage: India's No. 1 RBF Provider, typically works on 10% revenue share + flat fees, with no repayment cap, until the invested amount is repaid.

Clearco: Focused on e-commerce and DTC brands.

Pipe: Popular among SaaS businesses with recurring contracts.

Capchase: Tailored for subscription-based startups.

Uncapped: Non-dilutive growth capital for European startups.

These providers analyze revenue data through integrations with tools like Stripe, Shopify, or QuickBooks, making the funding process fast and data-driven.

RBF has long been used in the energy industries as a type of debt financing. In the late 1980s, Arthur Fox pioneered this funding model for early-stage businesses in New England. Seeing some initial success, he began a small RBF fund in 1992, which was found to perform on-par with expectations for the alternative assets industry, yielding an IRR of over 50%.

Conclusion: Is RBF Right for You?

Revenue-Based Financing (RBF) is a real solution for founders who want to grow without losing equity or suffocating under bank debt. If you’re running a SaaS, subscription, or e-commerce business with predictable revenue, RBF can provide the capital boost you need to scale while keeping your business under your control.

That said, always do your calculations. The repayment multiple may be higher than traditional debt, and if your growth stalls, repayments could drag on longer than expected. At the end of the day, RBF is not a silver bullet, it’s another tool in your funding toolkit. The smartest founders know that choosing the right funding path depends on their growth model, risk appetite, and long-term vision.

Found this article insightful; please help others to discover it by liking, sharing, and commenting below.

Comments