Corporate Venture Capital (CVC): Startups Leverage it for Growth!

- Jasaro.in

- Aug 9, 2025

- 7 min read

Updated: Aug 10, 2025

In the startup world, capital is fuel, and the right kind of fuel can determine how far and fast you can go. For most founders, venture capital (VC) is the dream: patient money that fuels innovation and rapid growth. But VC isn’t just one thing. Beyond traditional investors and operator-led funds, there’s a growing powerhouse in the funding ecosystem, i.e. Corporate Venture Capital (CVC). It’s a fascinating hybrid, blending the financial muscle of a large corporation with the agile innovation of a startup.

This article will walk you through what CVC is, the powerful advantages it can offer your startup, and the critical pitfalls you need to navigate.

What is Corporate Venture Capital (CVC)?

At its core, Corporate Venture Capital is the practice of large, established corporations investing directly in external startup companies. Think of it as the corporate world's answer to traditional VC. These are not just passive investments; they are often handled by dedicated investment arms or divisions within the large corporation.

Examples include Google Ventures, Intel Capital, Qualcomm Ventures, Salesforce Ventures, or Microsoft’s M12. They differ from traditional VC firms because their motives extend beyond profit. Many have invested in startups that align with their strategic roadmap, enhance existing offerings, or give them an edge in emerging markets.

Why Corporate Venture Capital (CVCs) Invest in Startups?

To truly understand if a CVC is the right partner for you, you must first understand their motivations. Why are these corporate giants dedicating billions to investing in risky, early-stage ventures? Essentially, the CVC investments in startups are motivated by two main objectives:

a. Strategic Investments

Here, the corporation invests in startups whose products or services complement their existing business or open up new strategic opportunities. E.g.,

Google Ventures (GV) invested in Uber early on, a bet that aligned with Google’s transportation and mapping ambitions.

Intel Capital backing AI and semiconductor startups to strengthen its hardware ecosystem.

In such cases, the strategic value, staying ahead of disruption and getting early access to emerging technologies, often outweighs the need for quick financial returns.

b. Financial Investments

Some corporations run their CVC arms much like a traditional VC fund, aiming for strong financial performance. But they leverage their deep industry knowledge, supply chain expertise, and market reach to spot opportunities earlier than traditional funds might.

Why Startups Should Prefer Corporate Venture Capital (CVC)?

When strategically aligned, CVC funding can give startups a competitive advantage far beyond what traditional VC offers.

i. Longer Investment Horizons

Stable Funding: Large companies can provide reliable investment, sometimes locking in future funds upfront. Because CVCs are funded by corporate balance sheets (not a fixed-term fund), they aren’t under pressure to exit in 5–10 years. This allows startups to grow at a sustainable pace, focusing on long-term product-market fit instead of short-term valuation spikes.

ii. Strategic Resources at Scale & Expertise.

Startups get help with things like technology, manufacturing, or business strategy. CVC partners can provide:

Manufacturing capacity, vital for hardware and IoT startups.

Distribution channels, global reach that would take years for a startup to build.

Brand halo effect, association with a major brand boosts customer trust.

R&D collaboration, co-development of new products or technologies.

E.g.: Qualcomm Ventures has helped multiple portfolio companies fast-track their go-to-market process by integrating them into Qualcomm’s global supply and distribution ecosystem. Nexa3D used Siemens' software and expertise.

iii. Market Validation: Credibility & Customers (Access to Markets)

Being backed by a big name makes the startup more trustworthy, and the large company's customers might become the startup's customers. Large company can help the startup reach more customers through its sales channels. A corporate’s backing serves as an endorsement that makes attracting customers, talent, and follow-on investors much easier.

iv. Possible Acquisition Path

For founders seeking a clear exit strategy, CVC can serve as a direct pipeline to acquisition if the partnership proves successful.

A Win-Win Proposition.

The corporations get fresh ideas and tech, while the startups get cash plus valuable help, connections, and credibility from its powerful partner.

It's a strategic partnership where both sides aim to benefit.

When CVC Makes the Most Sense for Startups (vs a VC)?

CVC funding is most valuable when:

The startup’s technology or product fits naturally into the corporate’s offerings.

The corporation can offer immediate, tangible resources (manufacturing, tech, distribution).

The industry is capital-intensive, such as biotech, semiconductors, or clean energy, where strategic backing can significantly reduce operational risks.

Stages Where CVC Typically Invests.

Corporate venture arms participate in multiple startup stages:

Seed Capital: Small checks to cover early expenses and validate ideas.

Early-Stage Financing: Product development and early market testing.

Expansion Financing: Funding to scale operations, enter new markets, or launch additional products.

Pre-IPO Support: Strategic positioning before a public offering.

Mergers & Acquisitions: Full integration when strategic value peaks.

Maximizing Value From a CVC Partnership

Founders should go beyond the term sheet and evaluate:

Strategic Alignment: Will the corporate’s priorities remain aligned with your vision over 5–10 years?

Resource Accessibility: Will promised resources actually be available to your team?

Governance Terms: Does the corporate seek board control or veto rights that may limit flexibility?

Independence Safeguards: Can you still work with other strategic partners?

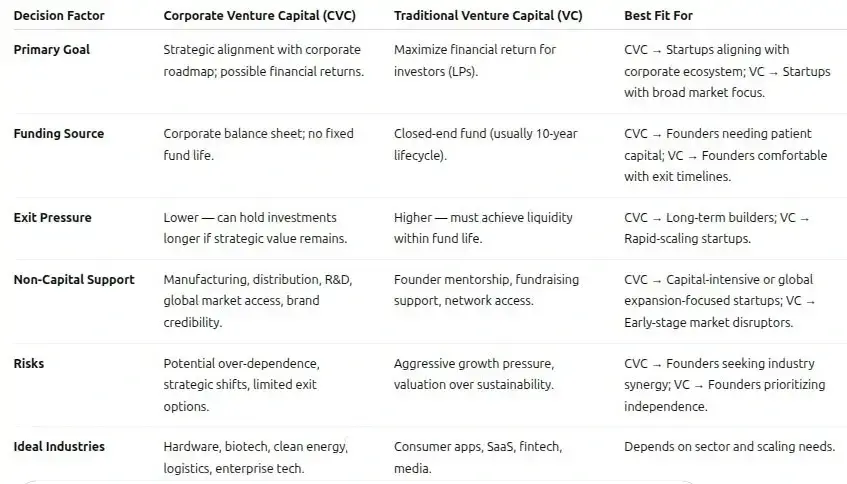

CVC vs VC Decision Framework for Startups.

Is Corporate Venture Capital Right for You (well, it depends.)

You need to assess the key motivations and expectations of the CVC. This chart should help:

Decision Framework:

If strategic fit + patient capital are your top priorities → Lean toward CVC.

If independence + speed matter most → Lean toward VC.

In some cases, a hybrid approach (having both CVC and VC investors) offers balance.

CVCs are less ideal, when:

Startups in direct competition with the corporate.

Founders aiming for broad market independence.

Businesses with niche markets are unlikely to scale into a corporate’s core focus.

Successful Case Studies of CVCs.

Nike partnered with Invertex to use their proprietary 3d modelling technology to make shoes that fit their customer's feet perfectly.

Amazon acquired Ring to offer customers a comprehensive home security solution and bolster their existing Amazon Key technology.

Siemens, a multinational engineering and electronics company, formed a strategic partnership with Nexa3D, a manufacturer of high-speed industrial 3D printers, in 2020.

As part of the partnership, Siemens provided Nexa3D with its automation and digitalization technologies, including its MindSphere IoT platform and Simcenter simulation software. In return, Nexa3D’s high-speed 3D printing technology was integrated into Siemens’ Additive Manufacturing (AM) Network, designed to enable the industrial-scale production of 3D printed parts. The partnership has allowed Siemens to expand its Additive Manufacturing (AM) offerings and provide customers access to advanced 3D printing technologies. It has also enabled Nexa3D to access Siemens’ extensive customer base and resources, accelerating its growth in the industrial 3D printing market. A win-win situation!

Intel Capital invested early in VMware when virtualization was still a niche concept.

The partnership provided VMware not only with capital but also with technical collaboration. VMware’s eventual acquisition by EMC (and later Dell) generated strong returns for Intel Capital, and cemented VMware’s position in enterprise IT.

Google Ventures invested in Cooliris, a photo-browsing startup.

Despite the strategic fit with Google’s visual search ambitions, shifting priorities at Google left Cooliris without strong internal champions. The company was eventually acquired by Yahoo Japan, a small exit compared to its early promise.

List of Indian CVCs.

Risks and Challenges of CVC Funding

The advantages are compelling, but CVC is not without potential pitfalls.

i. Strategic Dependency

If the corporate’s priorities change, say, after a leadership shake-up, your startup may find itself deprioritized or even divested.

Case in point: Some startups funded by media conglomerates in the early 2000s saw their funding dry up when the parent companies shifted away from digital bets.

ii. Competitive Motives

Not all investments are friendly. In some cases, corporations invest in startups to keep tabs on potential competitors, and later acquire them to integrate or shut them down.

iii. Cultural Misalignment

Startups are built on speed, agility, and a willingness to break things. Large corporations are often the polar opposite: slower decision-making cycles, bureaucratic, and a more risk-averse culture, which can frustrate fast-moving startup teams. This clash can lead to immense frustration, stifling the very innovation the CVC was hoping to foster.

iv. Acquisition Agenda

Sometimes, a CVC invests not to partner, but to possess or mitigate. They might see you as a potential competitor and invest early to control your growth, and the ultimate goal is to acquire you, and/or shelving your product to eliminate a threat.

v. Limited Exit Options

If a corporation owns a significant stake, it can deter other investors or acquirers, thereby making your startup less attractive to other potential acquirers, including the corporation's direct competitors. You risk being "locked-in" to a single potential exit path, which could severely limit your valuation.

Conclusion: CVC as a Growth Catalyst, If Chosen Wisely

Corporate Venture Capital can be a game-changer for startups, a source of funding, strategic resources, and credibility all in one package. When the relationship is grounded in true strategic alignment, it can accelerate growth without the unsustainable pressure of traditional VC timelines. Strategic fit plus long-term commitment creates a win-win outcome.

But, founders must remember: CVC is not free money. It comes with expectations, influence, and sometimes strings that can shape a company’s future in profound ways. The most successful founders approach CVC partnerships with clear/open eyes, a long-term plan, and contingency strategies. Done right, CVC can transform a startup’s trajectory from early promise to market leadership. Thus, Corporate Venture Capital can be a powerful co-pilot, but only if your destinations are aligned. Choose wisely.

Note: US-based Interactive Data Group, have chosen to primarily operate in emerging markets away from established mainstream media groups. Global Corporate Venturing selected US oil major Chevron as the most influential corporate venturing unit among the energy and natural resource companies.

Found this article insightful; please help others to discover it by liking, sharing, and commenting below.

Struggling to Raise Funding? Click here for Expert Assistance, or Register to pitch to 1,500+ Investors.

For ₹50 (< $1) per report, get access to 2,650+ or 4.3 GB of Comprehensive Research Data!

Comments