Content Source + Images: Brian Feroldi

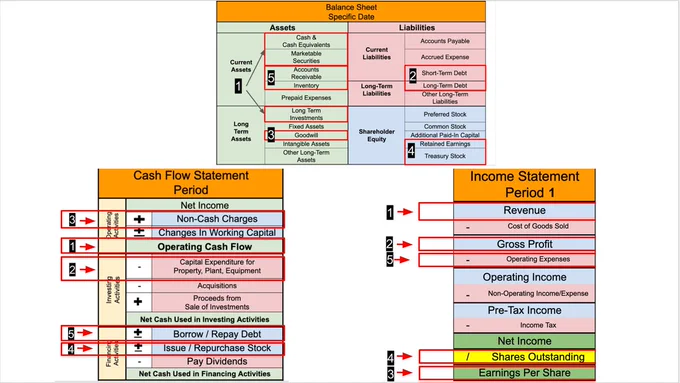

Every company (small or big) has 3 financial statements, wherein each answers a specific/unique question:

Balance Sheet: What’s your net worth?

Income Statement: Are you profitable?

Cash Flow Statement: Are you generating cash?

How to Read the 3 Financial Statements?

Please read this dummy guide for details, it helps even if you have no finance background. Skip and read further, if you already know this.

How to Quickly Analyze the 3 Financial Statements?

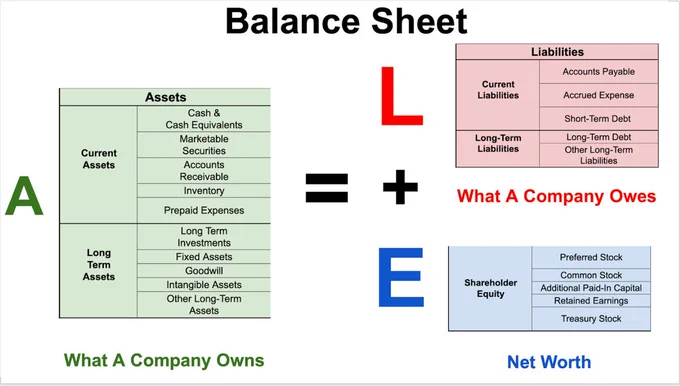

1. Balance Sheet

This tells you a company’s net worth at a specific point in time.

What should you focus on here?

Cash & Equivalents: How much?

Debt: How much debt vs. cash?

Goodwill: How much in value?

Retained Earnings: Positive?

Receivables & Inventory: How much?

Ideal Answers:

Cash & Equivalents: More than Debt

Short & Long-Debt: None

Goodwill: Zero

Retained Earnings: Positive

Receivables & Inventory: None

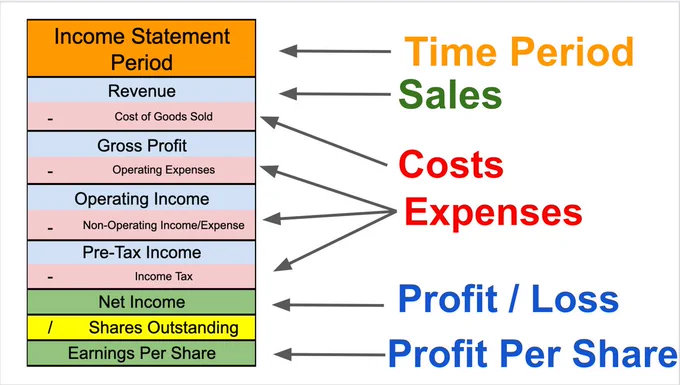

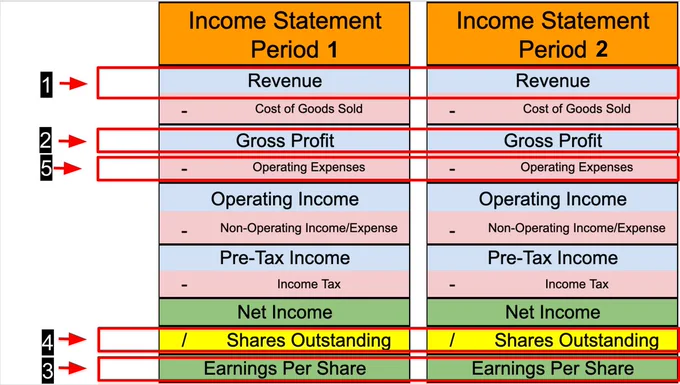

2. Income Statement

This tells you if a company is “profitable” or not during a period of time.

Always look at 2 income statements with comparable periods.

What should you focus on here?

Revenue: Up or down?

Gross Profit: Up or down?

EPS (Diluted): Positive or negative?

Shares Outstanding: Up or down?

Operating Expenses: Up or down?

Ideal Answers:

Revenue: 30% / more

Gross Profit: 30% / more

EPS: Up 30%

Shares Outstanding: Down 4%

Operating Expenses: Stable

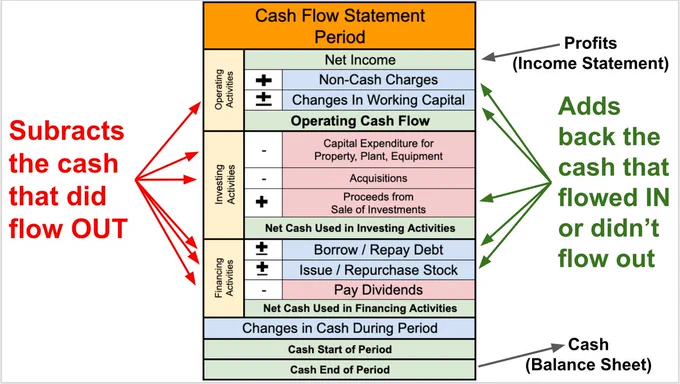

3. Cash Flow Statement

This tells you how cash moves in and out of a business over a period of time.

What should you focus on here?

Operating Cash Flow (OCF): Positive or negative?

CapEx (Capital Expenditure): More or less than OCF?

Net Non-cash Charges (NCC): Any big numbers? Any Stock-based Compensation (SBC)?

Stock: Issuance or buybacks?

Debt: Borrow or repay?

Ideal Answers:

OCF: Positive (and Growing)

CapEx: Much less than OCF

NCC: Nothing noteworthy + Low SBC

Stock: Buybacks?

Debt: Repayments?

Summary

Accounting (and investing) is filled with nuance. Still, with a quick analysis of each financial statement, you can quickly identify a company's strengths and weaknesses.

I’d never make an investment decision without MUCH more analysis than this.