Startup Funding: When to Raise, How Much & Why Most Get It Wrong?

- Jasaro.in

- Jul 22, 2025

- 5 min read

Updated: Sep 2, 2025

Startups don’t die from starvation, they die from indigestion. And startup funding, when misused or mistimed, can be the richest source of that indigestion. Over the past two decades, 1000s of startups either thrive or spiral out based on one deceptively simple decision: When and how much to raise money.

Too many founders chase funding as validation. They assume raising capital is the ultimate startup game. In reality, 95% of startups raise at the wrong time, either too early and dilute into oblivion, or too late and suffocate from cash flow issues.

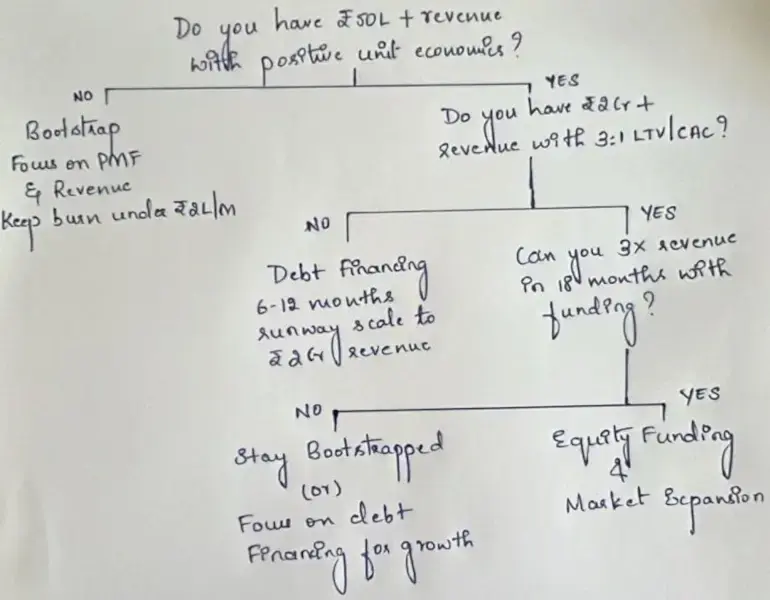

Startup Funding Decision Framework

If you’re serious about building a sustainable, profitable company, and retaining 60–80% ownership by the time you exit, then this framework will help you make smart, strategic, and timing-perfect funding decisions. Let’s break it down stage by stage.

Stage 1: The Bootstrap Phase (₹0 – ₹50L in Revenue)

Your Mission: Prove You Can Succeed.

In this early stage, everything revolves around one concept: Product-Market Fit (PMF). The only funding you should consider here is from personal savings, family, or revenue. Not because it's noble, but because anything else is a trap.

Why Bootstrapping Matters?

You don't know your market well enough yet.

Your product might still pivot.

You’re still validating whether your idea can survive.

Guidelines to live by:

Keep your burn rate under ₹2L/month.

Get your first 50 customers (10 in case of B2B) and validate unit economics.

Hire only the essential team members (2–5 max).

Build with speed and frugality, not investor expectations.

💡 Pro Tip: Avoid talking to VCs at this stage. If you've time to pitch, you’re not close enough to your customers.

Stage 2: Revenue-Based Financing (₹50L – ₹2Cr in Revenue)

Your Mission: Scale Without Losing Control.

Once you’ve got PMF, your goal is now profitable growth. This is where most startups make the fatal mistake of jumping to equity, and giving away their future. If your unit economics are solid and growth is healthy, revenue-based debt is a smarter choice.

Here’s when debt financing works beautifully:

Your monthly revenue grows at 15%+ for 6 consecutive months.

CAC payback period is under 12 months.

Retention rate is above 85%.

You’re not burning heavily to sustain growth.

Use this capital wisely: fuel marketing, not headcount. You don’t need 15 SDRs. You need better CAC-to-LTV leverage.

Key advantage: Debt doesn’t dilute your equity. If you’re planning to raise equity later, retaining control now pays off 10x down the line.

💡 Pro Tip: If you qualify for debt at this stage and still go for equity, ask yourself if you’re being strategic, or just scared.

Stage 3: Growth Equity (₹2Cr – ₹10Cr in Revenue)

Your Mission: Take the Big Swing (Only If You Can Hit It)

You’ve now built a growing machine. Customers stick, margins are healthy, CAC is in control. This is the first stage where equity makes sense, but only if you're ready to 3x your revenue in 18 months.

Here’s when you should consider equity:

You have a LTV/CAC ratio of 3:1 or better.

You can clearly see a path to ₹50+ Cr revenue in 3 years.

Your market size is ₹1,000+ Cr, and realistically capturable.

You need capital to build moats, not fix leaks, think R&D or nationwide expansion.

Also, your team should now be 25+ with functional leadership in place.

Investors don’t just fund traction, they fund teams that can scale that traction reliably.

💡 Important: If you’re not 90% confident the raise will 5x your valuation in 2 years, don’t raise. Wait.

Stage 4: Scale Funding (₹10Cr+ in Revenue)

Your Mission: Go Global or Go Big.

This is the phase where you’re no longer experimenting, you’re expanding. If you’re profitable or on the verge of it, and looking at international markets, strategic acquisitions, or new product verticals, it’s time to think bigger.

Series B/C funding round works, if:

You’re fighting for category leadership.

You’re entering new markets or segments.

You’re acquiring smaller players for speed.

You’ve shown investors that every rupee fuels predictable RoI.

This is where capital is leverage, not life support. You use it to buy time, capture markets, and build defensibility.

💡 Trap to Avoid: Don't raise to achieve vanity metrics. If you're not building moats with the capital, you're just building burn.

Startup Funding Rounds with Milestones that Matter!

Most founders obsess over the funding rounds i.e. Seed, Series A-C, but what importantly matters are the milestones you hit at each stage.

When NOT to Raise Money?

Most funding mistakes are made when founders raise for the wrong reason, or at the wrong time. You should not raise money if:

You haven’t proven product-market fit.

Your burn rate > 50% of revenue.

Customer acquisition is still a money pit.

You're just raising to extend the runway, without any strategic plan.

You’re in a niche market that can't scale.

You can reach the next milestone with cash flow + hustle.

💡 Harsh Truth: The best founders always wait longer than they’re comfortable before raising. It keeps them lean, sharp, and focused on fundamentals.

The Hard Truths You Won’t Hear from VCs!

80% of companies don’t need equity funding at all.

Most successful startups are profitable by ₹5Cr in revenue.

Raising too early kills more startups than bootstrapping ever will.

If you qualify for debt, it's almost always better than equity.

Each equity round should increase your valuation 5x within 2 years, or it's not worth it.

The Final Framework: From Bootstrap to Exit

Let’s boil it all down.

Bootstrap (₹0 – ₹50L) ➡ Focus on PMF. Avoid external money.

Debt Funding (₹50L – ₹2Cr) ➡ Accelerate growth with minimal dilution.

Equity Funding (₹2Cr – ₹10Cr) ➡ Only if you need ₹5Cr+ for big bets and can 3x in 18 months.

Scale-up (₹10Cr+) ➡ Raise (Equity) to dominate or expand.

The founders who stick to this roadmap often exit with 60–80% ownership.

The ones who chase funding too early? They're lucky to keep 10–15%.

Conclusion: Own Your Journey

Raising money should never be a startup’s goal.

Building something valuable, sustainable, and profitable should be.

Funding is just fuel, not the engine.

If you’re clear on where you are in your journey, what your next milestone is, and what kind of capital makes the most sense, you’ll outlast and outgrow most of your competition, without giving away your company to do it.

And that’s what separates the winners from the casualties.

Found this article insightful; please help others to discover it by liking, sharing, and commenting below.

Comments